Support for TCFD Recommendations

The UBE Group expressed its support for TCFD proposals in April 2020. We will assess and analyze the business risks and opportunities of climate change to the Group, reflecting these factors in our business strategy and disclosing information.

Disclosure Based on TCFD Recommendations

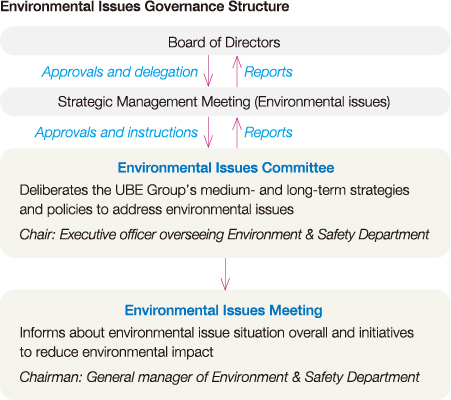

Governance Structure

The UBE Group established the Environmental Issues Committee to identify and act on problems in that regard. The President and CEO chairs the Strategic Management Meeting, which receives deliberation reports from the Environmental Issues Committee, provides instructions as needed, and constantly monitors countermeasures progress. A report on important matters goes to the Board of Directors once annually.

Strategies

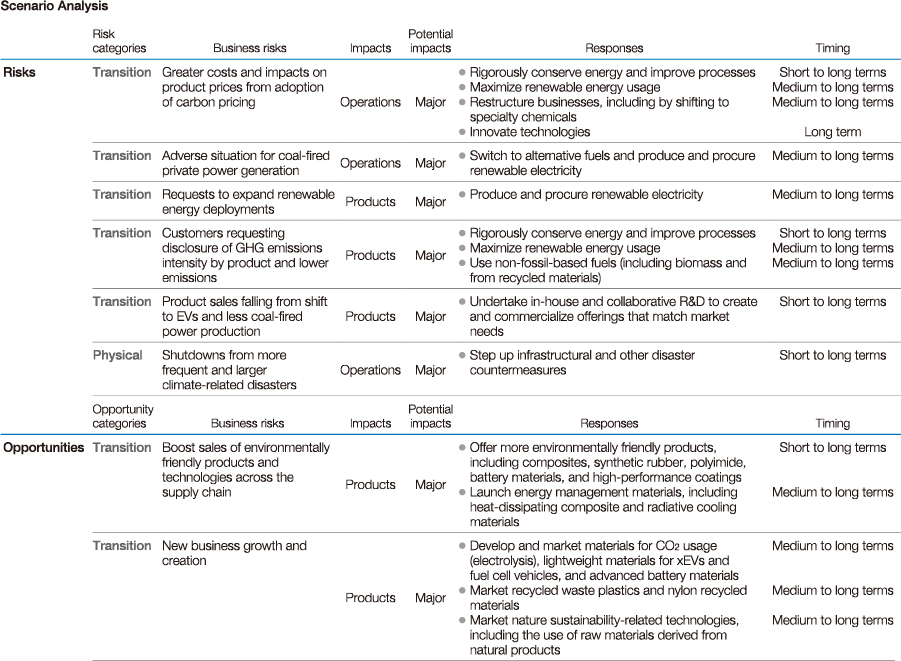

In view of efforts to tackle climate change and transition to a low-carbon, decarbonized economy, management assessed a range of scenarios for 2030 and beyond, analyzed risks and opportunities for the UBE Group under each scenario, and formulated the required strategies. The scenarios covered all business units, including for the Construction Materials Company, although the assessment below exclude information relating to that entity.

We explored and developed 2ºC and 4ºC transition scenarios and a physical scenario, and analyzed Group risks and opportunities in each scenario.

Analysis Assumptions and Details for Scenarios

| 2ºC Scenario | We used the Sustainable Development Scenario and the New Policies Scenario of the World Energy Outlook, and the Reference Technology Scenario and the 2ºC Scenario of the Energy Technology Perspectives as bases, augmented internal scenarios with other resources, and undertook a study. Our risk analysis considered carbon pricing, coal price, and alternative fuel scenarios. We developed forecasts for 2030 and scenarios for private power generation based on 2025 and 2040 data projections. Opportunity analysis encompassed forecasts for wider acceptance of electric vehicles (EVs) and alternative fuels through greater support for those vehicles and renewable energy. We also evaluated the risks and opportunities of policy scenarios supporting greater plastics recycling and industry deployments of carbon capture, usage and storage, and created assumptions about demand for our products and scenarios for R&D projects in coming years. We also analyzed energy system and CO2 emission pathways presenting at least a 50% probability of limiting a global average temperature increase to 2ºC by 2100. |

|---|---|

| 4ºC Scenario | We drew on the World Energy Outlook’s New Policies Scenario and coal price scenarios from Japan’s Nationally Determined Contribution and International Energy Agency. |

| Physical Scenario | We assumed and evaluated the impacts on UBE’s infrastructure and employees of higher sea levels, extreme rains, more devastating typhoons, and other climate events associated with rising temperatures under long-term perspectives based on the Representative Concentration Pathways 8.5 Scenario in the Fifth Assessment Report of the United Nations Intergovernmental Panel on Climate Change. We also factored in local hazard maps and other information near plant locations. |

Assessment Steps

- Evaluate business unit performances under each scenario, including forecasts for private power generation

- Analyze UBE Group prospects based on findings for each scenario

- Develop resilience strategy for 2030 in preparation for 2050

Findings from the Scenario Analysis

The chart below summarizes findings from the scenario analysis, the financial impact in around 2030, and the prospective impact.

Risk Management

We maintain a risk management system, for which the Risk Management Department serves as the secretariat, to register and centrally oversee risks. We identify pertinent risks for each division and business unit, classifying them as major, medium, and minor in line with their risk impacts. We define major risks as having financial impacts of at least ¥1 billion. The Strategic Management Meeting discusses major business risks, reflecting them in specific strategies and measures.

We registered and manage our climate change countermeasures in our risk management system. The Environmental Issues Committee, whose chair is the executive officer in charge of the Environment & Safety Department, is a Companywide entity. The committee formulates and implements measures and policies to address climate change-related risks that it has identified for the UBE Group overall.

Detailed information is available in the Risk Management section of the UBE Group’s website.

Benchmarks and Targets

Following a review, we established the following fiscal 2030 goals for our efforts to tackle environmental issues.

- GHG emissions: Cut by 50% from fiscal 2013 level

- Environmentally friendly products and technologies as a percentage of consolidated net sales: At least 60%

Data scope: Scope 1 and Scope 2 on a consolidated basis for designated energy management companies and key overseas businesses (in Thailand and Spain).

Detailed information is available in the Global Environmental Issues section of the UBE Group’s website.

We look to reach these GHG emissions reduction goals by halting ammonia production in Japan by 2030 and by transitioning to specialty chemicals.

Our fiscal 2021 GHG emissions were 4.31 million tons (excluding cement-related business that we transferred to Mitsubishi UBE Cement Corporation). This was 9% below the level of fiscal 2013, and reflected energy-saving and other initiatives.

Sales of environmentally friendly products and technologies rose approximately 4 percentage points in fiscal 2021, accounting for roughly 46% of consolidated net sales.